What Is External Asset Management (EAM)?

An EAM is on the front-end of private banking that best serves clients through tailored investment strategies and constant asset allocation monitoring, including tax consultation, cash management, trading, estate planning and inheritance management.

EAMs are managed by Independent Asset Managers (IAM) who, unlike traditional private banks, operate outside of the rigid structures of large financial institutions – and are thus free to pursue global solutions in the interest of their clients.

Our EAM Platform

An entrepreneurial platform without boundaries, our EAM platform was set up to serve IAMs and like-minded private bankers looking to achieve greater autonomy in their professional careers while staying aligned to their client’s interests.

By consolidating key services in a one-stop location, this platform allows IAMs and private bankers to leverage vast global resources as well as the support of our dedicated administration and advisory teams.

Unlimited Flexibility

With vast privileges enabled through our partnership comprising a large number of banks and service providers unbound by traditional institutionalised restrictions, our EAM platform gives IAMs and private bankers powerful tools to revolutionise the way they serve clients – and ultimately drive their career development in ways not possible before.

Convenience

In addition to giving users unlimited options and unprecedented flexibility to tailor financial solutions, the highly interconnected EAM platform also allows clients to retain their current accounts even if their IAM switches associations – thereby avoiding the need to initiate cumbersome administrative tasks, or restart entire relationships possibly built over years.

Internal Administration & Advisory Team

Supporting the EAM platform from within a strong business administration team that is responsible for compliance, operations, and administration – thereby freeing IAMs to focus their attention on financial markets and align its plans and actions to the interests of clients.

— — Our AOA Model (Administration, Open Architecture, Advisory)

We are here for you.

Our Service Process

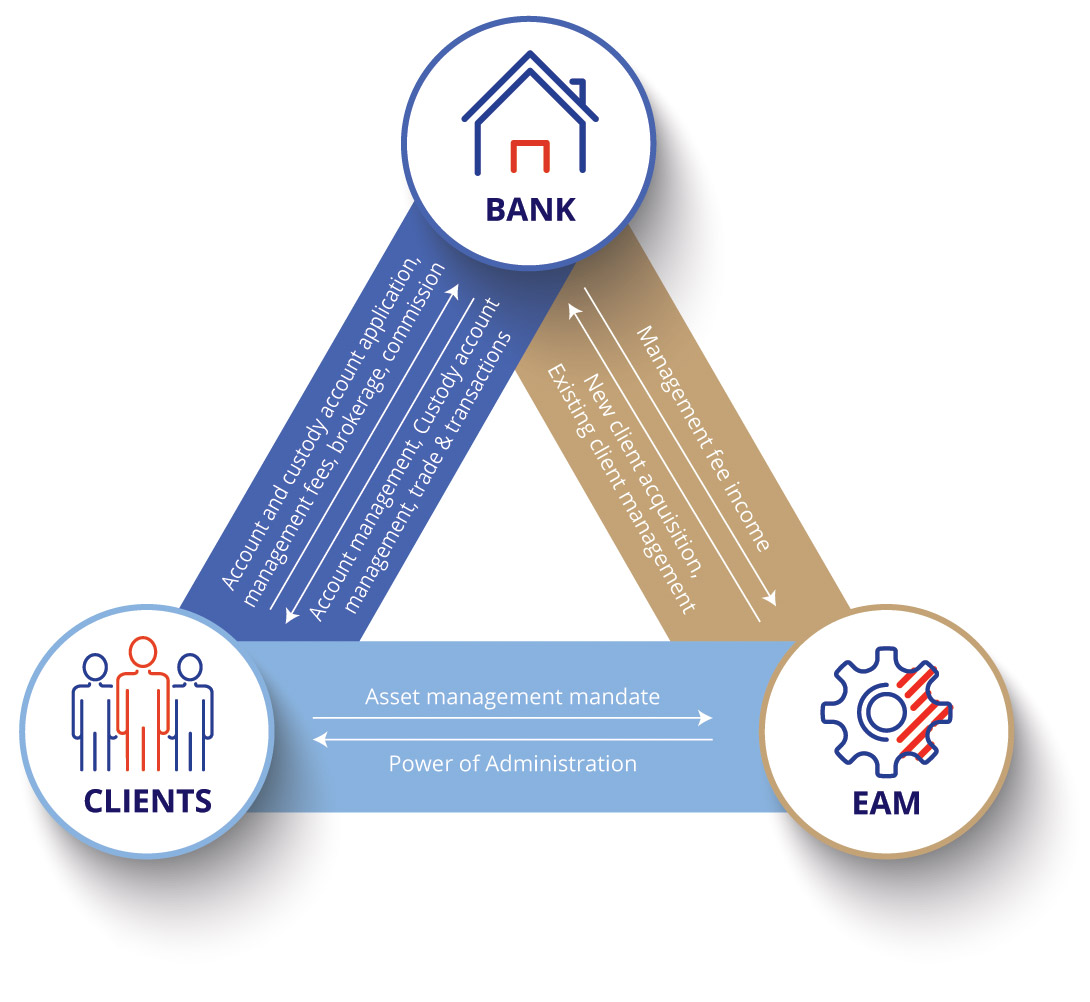

Clients:

- The client provides an advisory or discretionary mandate to the IAM on its asset management goals which it then carries out with Limited Power of Attorney (LPOA).

- Portfolios are tailored to suit the client’s needs.

- Clients are charged a transparent fee that will be commensurate with services rendered.

- Access to CIO recommendations, product selections, and outlook are made available at all times.

Banks:

- Banks act as the custodian of client’s assets, providing execution-only services.

- Clients retain full ownership and control over their assets. No assets are held either by the IAM or Viceroy Private Wealth.

- The IAM submits trade orders to the bank on behalf of the client.

IAMs:

- Discretionary licensing for Capital Markets Services (CMS) under the Singapore Securities and Futures Act (SFA), as well as Fund Management (Type 9) and Advisory (Type 4) for professional investors in Hong Kong.

- Providing relevant market research and executing trading in conjunction with custodians (VPW has agreements with more than 30 custodians globally).

Why EAM is the Future

1. Better Alignment of Interest and Autonomy

Unhindered access to large financial institution ecosystems.

2. Higher Standards

Independence and flexibility to select from a wide range of service providers to achieve better results.

3. One-Stop Solution

Consolidates multiple custodials and allows for full autonomy with multiple service providers.

4. Greater Stability

Static mobility and stronger partnerships.

5. Better Economy

IAM remuneration packages directly linked to business revenue.