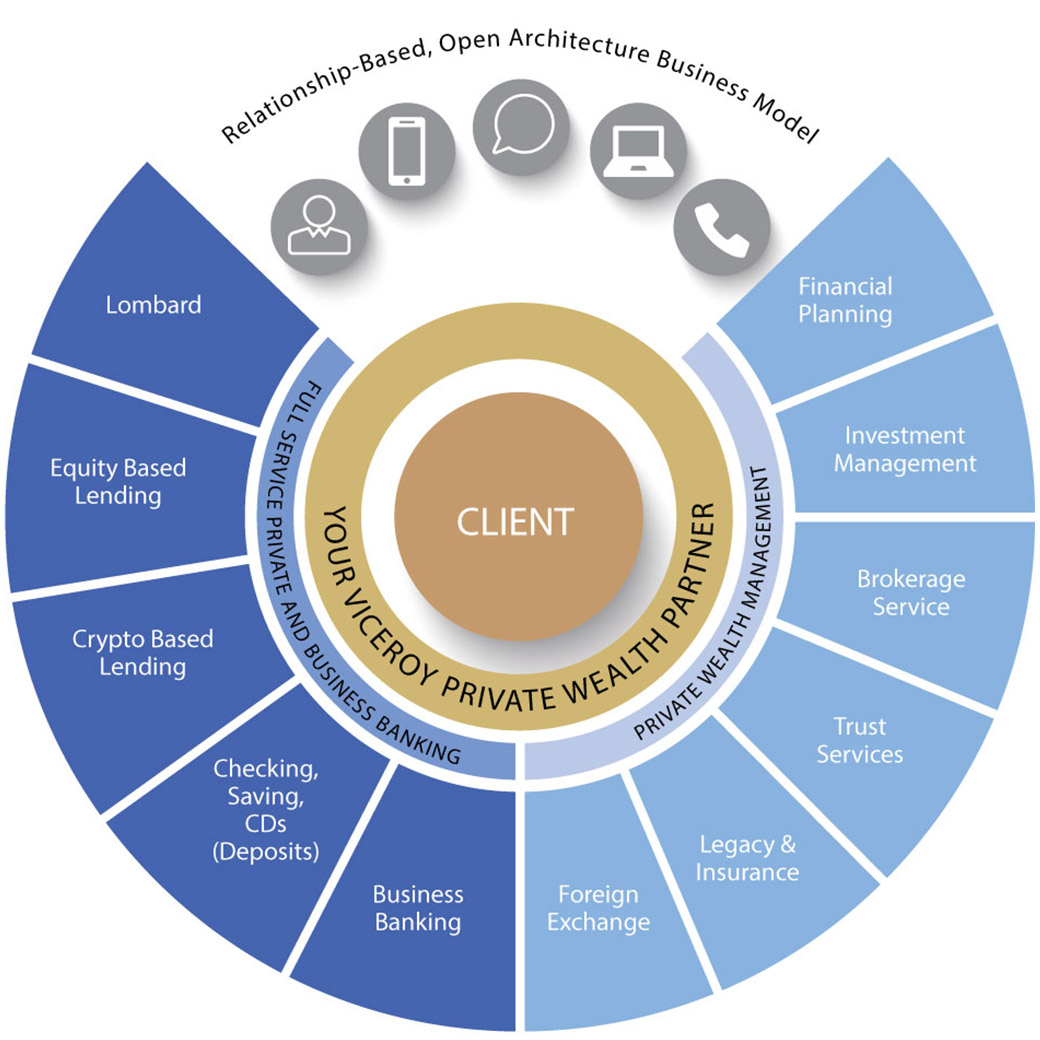

Private Wealth Management

You know your business and family better than anyone else. To aid you in planning and executing your plans for the future, we give you access to local expertise and global insights – and offer you meaningful, tailored advice for your present and future generations.

1+1+1 Butler-Style Financial Services: HERE FOR YOU

We are an exclusive wealth partner, comprising a team of private banking investment advisors that sit outside of large financial institutions to provide open and unfettered access to classic services offered by private banks and wealth advisors – from planning, investing, borrowing, and banking – all in one place.

In addition, we protect your assets and information relentlessly while connecting you to unique opportunities and people within financial institution networks throughout our platform.

Client Benefits

The following are the key benefits clients will receive through our platform:

Competitive Price

Pricing structures based on attractive terms negotiated with multiple private banks and investors.

Broader Access

Unrestricted access to a range of products, services and investment options, as well as multiple business divisions.

Discretionary Portfolios

Sophisticated portfolio presentations requiring tailored solutions in addition to ongoing portfolio support and management.

Research & Advisory

Comprehensive solutions provided by a wide range of leading products and services, courtesy of in-house professionals.

Consolidated Balance

Leading market services and administration turnarounds, with assets reviewable at a glance.

VIP Client Events

Regular events and product showcases to further improve client servicing support.

Our Services

Foreign Exchange (FX)

- Spot

- Forward

- Non Deliverable Forwards

- Swaps

Structured Deposit

- Fixed/ Floating/ Variable Coupon

- Medium and Long Terms

- Interest Rate Linked

- FX Linked

Over-The-Counter Derivatives

- FX Accumulator/ Decumulator

- FX Vanilla Options

- FX Barrier Options

Deposit

- Multi-Currency Account

- Time Deposit

Liquid Investments

- Money Market Funds

- Dual Currency Investment

Bancassurance

Services

- Universal Life

- Single Premium Whole Life

- Investment Linked

Private (Discretionary) Mandate

- Balanced Asset Allocation

- Focused by asset Class

- Dynamic Asset Allocation

Fiduciary Services

- Trust Companies

- Wealth Planning

Financing

- Universal Life

- Lombard Credit

- Equity based Lending

- Crypto CCy Based Lending

Tax & Corporate Service

- Offshore/ Onshore Incorporation setup (Investment Holding / FO)

- Tax Planning

Security

- Exchange Traded Funds

- Equities

- Option

Fund

- Bonds, Balanced, Equity

- Global, Regional, Sector

- Fixed Maturity Products

Structured Products

- Equity, Foreign Exchange, Indices, Interest Rates, Commodity, Credit, and Hybrid

- 100% Minimum Redemption Noted

- Non-Principle Guaranteed Notes

Fixed Income

- Fixed Income Security

Alternatives

- Hedge Funds

- Commodity Funds

- Private Placement

- Commodity Trading

- CFD

Viceroy Private Wealth Management Platform

IPO Allocations &

New Bond Issues

Open Architecture

Access & Pricing

Institutional

Solutions

Real-Time

Online Access

Full Credit Facilities

Access

Security & Solid

counterparty

Specialist Network

of Advisors

24-Hour

Trading Platform